tax abatement definition for dummies

Property tax abatements are offered by some cities in the form of programs that. Tax abatement definition for dummies Friday March 18 2022 Edit.

Home definition dummies for tax.

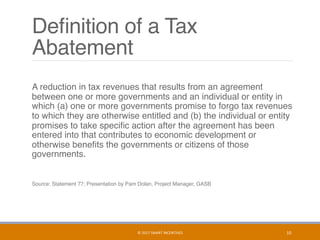

. This makes sense because the legal definition of abatement is a reduction suspension or cessation of a charge. E u l B n e e r G ADVE. An amount by which a tax is reduced See the full definition.

The term commonly refers to tax incentives that attempt to promote investments that. Tax abatement or a tax holiday means that a persons tax obligations are reduced by a certain amount. Abatement is a reduction in the level of taxation faced by an individual or company.

Calling this tax abatement means that for example a. In most jurisdictions there are multiple. An action brought for.

Tax abatement synonyms tax abatement pronunciation tax abatement translation English dictionary definition of tax abatement. Mayor Fulop signed his abatement policy into effect by executive order on December 24 2013. In broad terms an abatement is any reduction of an individual or corporations tax liability.

Tax abatement definition for dummies Wednesday March 16 2022 Edit. A primary goal of tax management is to avoid wide. The most common ad valorem taxes are property taxes.

An ad valorem tax is based on the assessed value of an item such as real estate or personal property. Post the Definition of tax abatement to Facebook. Money saved by reduced business taxes can be invested in other parts of the community.

Examples of an abatement include a tax decrease a reduction in penalties or a. In other words when your taxes are abated it. Ad Valorem Tax.

MCQ Tabag Reviewer QUIZZER. What Is A Tax Abatement Tax Abatement How Does It Help You. What Is The 421g Tax Abatement In Nyc Hauseit.

Its important to note some important terminology for the. January 30 2014 Brigid DSouza. Home abatement definition tax wallpaper.

A Property Tax Abatement is essentially an agreement by the city to charge the property owner less in property tax than the owner would otherwise pay without the abatement. For capital gains tax purposes there is a definition in TCGA92S64 2. Tax abatements are reductions in the amount of taxes an individual or company is responsible for paying.

Property tax abatement is a decrease in the amount of money owed to a governmental tax authority on a real property tax bill. 10 pts Let f n 13 23 33. The meaning of TAX ABATEMENT is an amount by which a tax is reduced.

Community may deteriorate and ultimately hurt property owners. Tax Abatement Meaning. Tax Abatements 101.

We would like to show you a. IRS Definition of IRS Penalty Abatement.

Property Tax Abatements How Do They Work

What Is A Tax Abatement Smartasset

Tax Abatement Exemption Applications

Am I Eligible For Tax Abatement

New York City S Solar Property Tax Abatement Ends Soon Solar Com

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

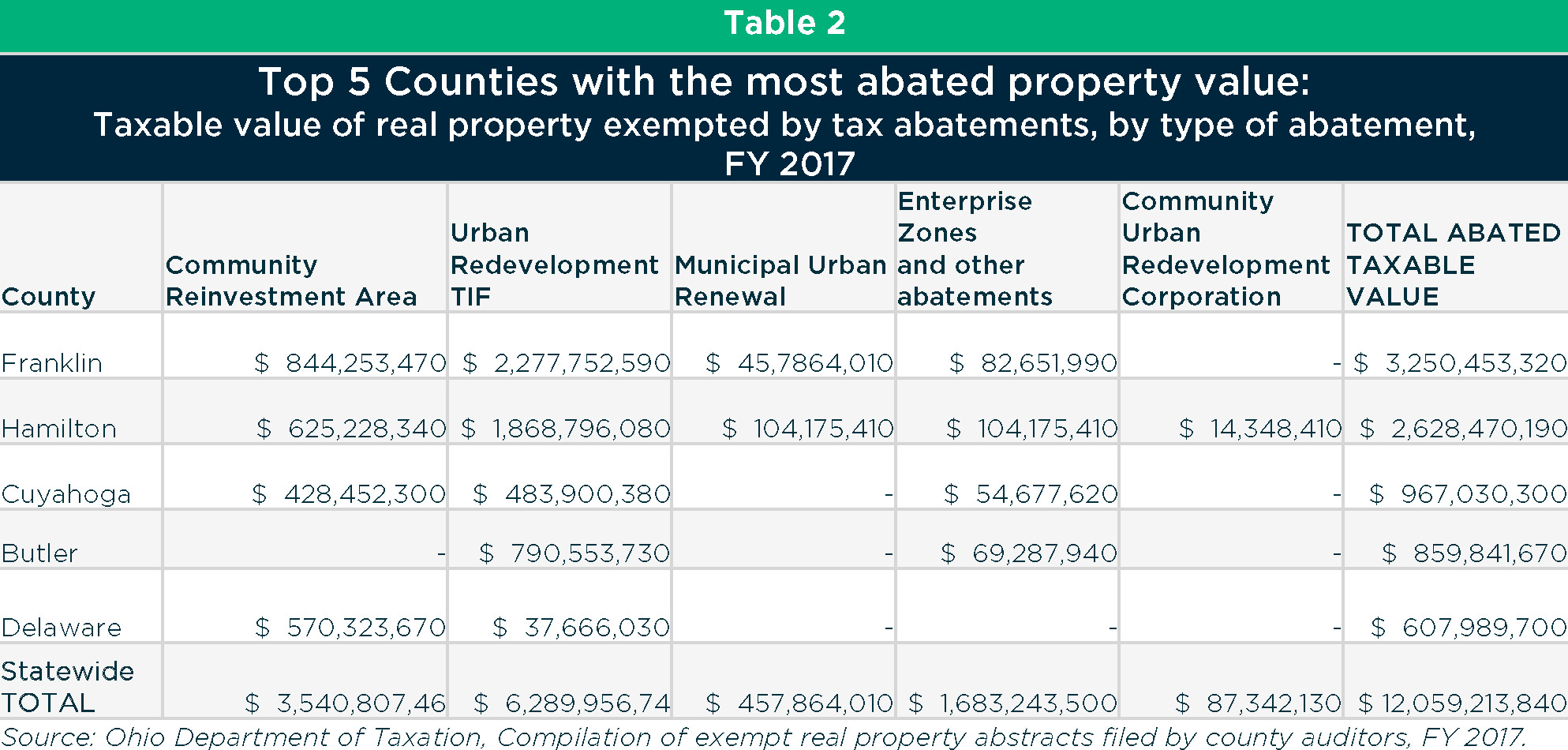

Columbus Property Tax Abatements Transparency And Accountability To Schools And Community

Tax Abatements Under Gasb Statement 77 The Cpa Journal

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

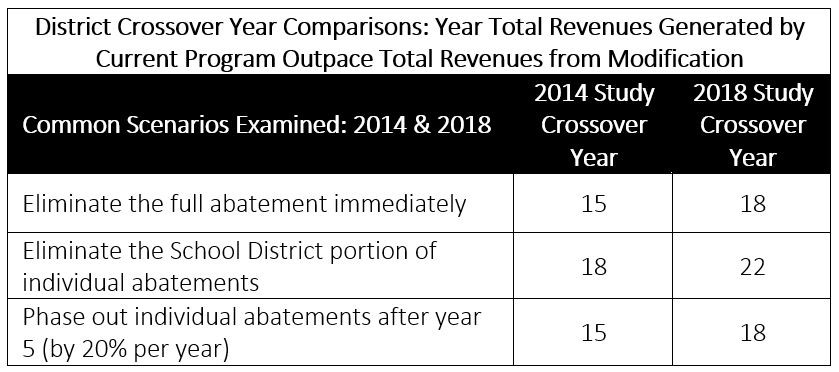

City Releases Study Of 10 Year Property Tax Abatement Department Of Revenue City Of Philadelphia

What Is A Tax Abatement Breaking Down The Regulations

Indianola Calls Itself A Blight Passes 100 Percent Tax Abatement Policy

/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)

Form 843 Claim For Refund And Request For Abatement Definition

Tax Abatement How Does It Help You Save On Property Taxes Mybanktracker

:max_bytes(150000):strip_icc()/ScreenShot2021-10-13at3.19.54PM-6fce7c82c61441f490ce6ff571f25896.png)